AtkinsRéalis [SNC-Lavalin Group Inc.] (TSX: ATRL), a fully integrated professional services and project management company with offices around the world, announces that it has been awarded a multi-year Master Service Agreement (MSA) for Project Management Office (PMO) and Owners Engineering (OE) Services in the northeastern United States byAvangrid Networks, a subsidiary of leading sustainable energy company Avangrid Inc. (NYSE: AGR.) AtkinsRéalis has provided Avangrid with similar services under multiple agreements during the last eleven years.

“We are committed to delivering technology-based solutions to support the energy transition so future generations can reap the benefits of a more sustainable, low carbon world,” said Ian L. Edwards, President and Chief Executive Officer, AtkinsRéalis. “As a trusted delivery partner for clients around the world, we bring reliability, stability, security and automation to the modern-day power grid through assets that meet the needs of the changing energy landscape.”

Under the MSA, AtkinsRéalis will provide engineering support and manage planning, controlling, permitting, environmental studies, public communications, field construction management, procurement, construction, commissioning and other services for Avangrid’sextensive capital expenditure (CAPEX) projects. The services will be provided to four electric utilities or operating companies/property companies (OPCO/PROPCO): Rochester Gas and Electric (RG&E), New York State Electric and Gas Company (NYSEG), Central Maine Power (CMP), and United Illuminating (UI).

“Our longstanding relationship with Avangrid combined with our time-tested methods, techniques and processes uniquely positions us to continue to successfully deliver on the company’s business objectives,” said Steve Morriss, President, U.S., Latin America, and Minerals & Metals, AtkinsRéalis. “We have a strong understanding of project scopes, constraints and timelines, which enables us to drive cost efficiency and produce value from our client’s investments.”

AtkinsRéalis has a proven track record of working with leading electric utilities and industrial companies throughout the northeastern United States and across North America, completing similar programs worth US$20 billion during the last ten years. The Company previously supplied capital project OE services to Avangrid for operating companies RGE and NYSEG. AtkinsRéalis has provided operating companies CMP, NYSEG, RGE and UI with capital project PMO services through contracts with Avangrid in the past as well.

AtkinsRéalis | www.atkinsrealis.com

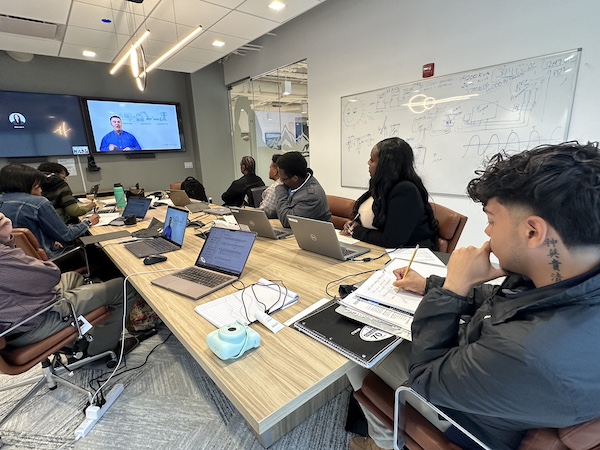

Nexamp, the nation’s largest community solar company, has just launched a new fellowship program in partnership with the City Colleges of Chicago that is designed to create opportunities for underserved or underrepresented populations to gain exposure to the many rewarding career opportunities in the renewable energy field. The company, which recently announced that its Chicago office would serve as its second national headquarters as it invests more than $2 billion in the region to expand clean energy, is delivering on its commitment to job creation and local impact.

The first cohort of fellows, which includes students from Olive-Harvey College and graduates from the Chicago Urban League’s solar energy jobs training program, began the eight-week program in mid-April, participating in a combination of in-office and on-the-job training in areas such as solar technology, construction, project management, IT, supply chain, safety, inspection, office skills, interviewing, and much more. Having already expressed their interest in the renewable energy field, fellows will explore a variety of opportunities with the goal of determining which Nexamp role or industry position is the one they feel is the best fit and would most like to pursue.

“As leaders in the energy transition, we feel a responsibility to ensure that the opportunities created are available equally to all,” notes Marion Jones, Vice President of Workforce Development and DEIJ Engagement, Nexamp. “Our company is built on the mission of making clean energy simple and accessible, and that extends right through to the jobs created. Giving people with an interest in this space a chance to gain the skills necessary for success will benefit the industry as a whole and we are grateful to City Colleges of Chicago for collaborating with us.”

Participants will attend training at Nexamp’s downtown office two days a week for four hours each day, receiving professional development and mentorship from industry leaders while building connections with other fellows. Training includes both classroom time and numerous site visits where fellows will engage in typical field tasks. This interactive and highly collaborative program also enables fellows to earn industry-recognized certifications while simultaneously preparing them for post-fellowship job opportunities through the included job-readiness sessions.

“This fellowship program is a powerful complement to the academic offerings at Olive-Harvey College, enabling students to gain real-world experience in a rapidly growing field,” says Dr. Kimberly Hollingsworth, President of Olive-Harvey College. “In this program they are developing critical career skills and forming connections that will bolster their success in the near future. City Colleges is looking forward to expanding this to all of the colleges.”

“For our students coming out of the Solar Energy Jobs Training program, which is focused on classroom and lab activities, being able to step into the daily operations of a leading real-world solar company adds tremendous value. It’s a perfect bridge that helps them apply what they’ve learned and make important connections as they consider where they might fit in the industry,” explains Andrew Wells, Vice President of Workforce Development at the Chicago Urban League.

Fellows receive hourly compensation during the 8-week program and priority consideration for open positions at Nexamp upon completion. Nexamp will be welcoming the next cohort in Chicago next month and plans to expand this model to its other offices across the country.

For more information about the fellowship program, email [email protected].

Nexamp | www.nexamp.com

Chicago Urban League | www.chiul.org

StoreDot, the pioneer and world leader in extreme fast charging (XFC) battery technology for electric vehicles, and Polestar, the Swedish electric performance car brand, revealed a groundbreaking milestone by demonstrating pioneering battery technology that charges an electric vehicle in just 10 minutes.

In the demo video seen here the companies successfully charged a 77kWh battery pack powered by StoreDot's extreme fast charging high energy (300Wh/kg) silicon-dominant battery cells, installed in a fully driveable verification Polestar 5 prototype, from 10% to 80% in under 10 minutes.

The vehicle saw a consistent charge rate of over 310kW for the entire test procedure and a peak of more than 370kW. All cell parameters including temperature, voltage and charged capacity were monitored throughout, with the battery pack never exceeding the target operating temperature set by engineers of both teams.

The demo showcases StoreDot's 'drop-in' ability to be integrated in an existing car model. It also paves the way to extreme fast charging a car using available charging infrastructure, rather than using proprietary chargers.

This world first demonstration featuring a 10-minute charge with silicon-dominant battery cells in an electric vehicle showcased unprecedented charging speeds that will eliminate consumer charging anxiety, a major obstacle to widespread EV adoption.

A key advantage of the silicon-based anode technology is the ability to continue pushing both energy density and charging rate boundaries for several more battery generations. In contrast, conventional graphite anodes are already approaching their theoretical performance limits, restricting further advancements. StoreDot's silicon design provides a crucial pathway to sustained innovation in areas like extreme fast charging.

The breakthrough was enabled by StoreDot's advanced XFC battery cells and represents another major milestone on the company's path toward commercialization, proving the maturity, stability, and durability of its game-changing technology, while paving the way for an industry-wide XFC battery adoption.

Dr Doron Myersdorf, CEO of StoreDot:

"We are very excited to share this impressive achievement today and are proud to be on this journey with Polestar, a leading car brand who envisions high performance cars with a sustainable future. We're happy to see our partner is among the first EV car makers to acknowledge that XFC is now a necessary standard to make vast EV adoption a reality. With our extreme fast charging technology, you can add 200 miles in under 10 minutes. This breakthrough revolutionizes EV ownership experience by eradicating the barrier of range and charging anxiety once and for all. Drivers can now truly travel long distances with the same freedom and convenience as traditional petrol-powered vehicles."

Thomas Ingenlath, CEO of Polestar:

"By eliminating charging times that were previously an obstacle, StoreDot's XFC battery cells combined with our cutting-edge product development and battery engineering have unlocked new frontiers for electric mobility. This technology will reshape consumer expectations and accelerate mass EV adoption by making EV ownership a seamless experience for the mass market."

In January StoreDot announced its anticipated milestones for 2024, one of which was today's demonstration. Other upcoming milestones include shipping prismatic B-samples to OEMs and signing strategic manufacturing agreements.

StoreDot remains firmly on track with production-readiness of its XFC cells that deliver 100 miles charged in 5 minutes this year. The company aims to deliver 100 miles charged in 4 minutes in 2026 and 100 miles charged in 3 minutes by 2028.

StoreDot | https://www.store-dot.com/

Polestar | https://www.polestar.com/uk/

As strong economic development successes and population growth power the Carolinas' energy needs, Duke Energy's goal is to ensure energy reliability for its customers. Duke Energy recently completed upgrades to the four units at the Bad Creek pumped storage facility in Salem, S.C.The upgrades add a total of 320 megawatts of carbon-free energy to the company's system and brings the total capacity of the station to 1,680 megawatts.

A flexible, dynamic, efficient and green way to store and deliver large quantities of energy, pumped storage hydro plants store and generate energy by moving water between two reservoirs at different elevations.

Coming online in 1991, Bad Creek is designed to produce significant amounts of energy when our customers need it most, performing a vital role as the largest "battery" on the company's system.

"This investment in Bad Creek demonstrates our commitment to improving reliability across the Carolinas. Pumped storage technology gives us operational flexibility, allowing us to store energy and then deploy that energy when customer demand is highest," said Preston Gillespie, executive vice president and chief generation officer and enterprise operational excellence. "Expanding our energy storage capabilities is just one of the many steps we are taking in the next phase of our energy transition."

The units were upgraded in phases, adding 80 MW of capacity to each new pump turbine. Unit 2 was completed in 2020, unit 1 was completed in 2021, unit three was completed in 2023 and unit 4 was completed in April.

Duke Energy is currently working to extend the license of the Bad Creek pumped hydro storage facility, which is set to expire in 2027. In addition to this upgrade project, Duke Energy is evaluating the potential to add a second powerhouse at Bad Creek that would further help Duke Energy add capacity to the system as well as address increasing system variability, from the growth of solar and customer usage, in a reliable and affordable way. If pursued, the second powerhouse could be in-service as earlier as 2034.

"From population growth to the expansion of manufacturing and other major economic development wins, the Carolinas are booming," said Mike Callahan, Duke Energy's South Carolina president. "We must have a diverse energy mix to account for this growth on the coldest winter nights and the warmest summer days. We continue to look at solutions like expanding Bad Creek to make sure the power is there when customers need it, and it is as affordable as possible – providing certainty as they go about their daily lives."

Expanding operations at Bad Creek also provides significant economic benefits of $7.3 billion to South Carolina, as the state benefits from construction and general infrastructure activity, by 2033.

Duke Energy | duke-energy.com

energyRe announced that it has secured $155 million in project financing and a $85 million tax equity commitment for its 108 MWdc Lone Star Solar project and 198MWh Battery Energy Storage System (BESS), one of the largest battery systems in South Carolina. Lone Star Solar is under construction and is expected to be operational by Fall 2024.

The $155 million in project financing for Lone Star Solar includes construction debt, tax equity bridge facility and letter of credit facility with Santander acting as the Coordinating Lead Arranger. Bank of America has committed $85 millionin tax equity. The project qualifies for Investment Tax Credits (ITCs) under the Inflation Reduction Act (IRA). The transaction, led by the energyRe M&A and Investments teams, showcases energyRe's deep industry knowledge, financial acumen, and expertise in securing compelling financing solutions for its pipeline of renewable energy projects.

"Lone Star Solar reflects energyRe's commitment to accelerating the U.S. energy transition with reliable, clean power," said Miguel Prado, CEO of energyRe "We are grateful to our financial partners for supporting Lone Star Solar, which will be one of the largest solar and storage facilities in the Southeastern United States. Today's announcement underscores energyRe's market leadership and our proven track record of delivering results for our communities."

"We are delighted to support energyRe in their first U.S. tax equity transaction," said Todd Karas, Head of Renewable Energy Finance at Bank of America. "We recognize the Lone Star project as a milestone in energyRe's growth and a noteworthy development for the State of South Carolina."

"Santander is very proud to have supported energyRe in its first U.S. project financing," said Nuno Andrade, Head of U.S. Global Debt Finance, Santander. "energyRe has positioned itself as a key player across an array of generation and transmission assets in the U.S., which we know are crucial to decarbonizing the energy sector and delivering clean energy jobs. We are truly appreciative of energyRe's partnership and trust."

In January 2023, energyRe announced a 10-year power purchase agreement with Dominion Energy South Carolina (DESC) for Lone Star Solar. Upon completion, Lone Star Solar will be one of the largest solar and storage facilities in the Southeastern United States and will have the largest battery on the DESC network. Over the life of the project, Lone Star Solar will generate more than $10 million in local property taxes and create approximately 185 jobs during construction.

Syensqo, formerly part of the Solvay Group, will purchase 100 percent of the renewable energy certificates (RECs) generated by Lone Star Solar; the clean power generated by Lone Star Solar will help Syensqo reduce carbon emissions for approximately 35 percent of its U.S. electricity purchases and decrease greenhouse gas emissions of its operations by 73,000 metric tons annually.

This announcement builds on energyRe's track record of investment and clean energy development in the Palmetto State. energyRe has more than 700 MW of contracted solar projects in South Carolina and a regional development pipeline of more than 7 GWs.

energyRe | www.energyre.com

RSF Social Finance added three new loans to its portfolio in the first quarter of 2024, investing a total of $5.5 million in three social enterprises that are challenging the status quo and creating positive impact in the energy, food, and finance sectors.

The loans support four of Sunwealth’s community solar projects; fuel 88 Acres, a women-founded and -led company that makes whole-food snacks, through a growth spurt; and back the transition of Natural Investments to a perpetual purpose trust ownership structure.

“We’re happy to provide new resources to these excellent companies in three of our core lending areas: alternative ownership, climate and environment, and natural products,” said Michael Jones, RSF’s vice president of lending business development. “We’re also pleased to expand our relationship with the mission-driven Walden Mutual Bank, which is a partner on two of these loans.”

Sunwealth: increasing access to affordable solar power

RSF led a $3 million loan, with participation from Walden Savings Bank, for Massachusetts-based Sunwealth, which addresses climate change in a way that not only protects the most vulnerable communities but also gives them a real share in the clean economy. RSF has now invested $13 million in the solar developer, the largest commitment the lender has ever made to a single borrower.

The latest funding supports four solar projects, located at a school in San Juan Capistrano, Calif.; a community homeowners association building in Hemet, Calif.; a nonprofit music camp in Sidney, Maine; and a commercial site in Woodbridge, N.J. The installations provide clean, renewable energy while delivering extensive benefits to their communities. Combined, they will generate about $11 million in lifetime energy savings, reduce over 85,708 metric tons of carbon emissions, and create nearly 118 lifetime solar jobs.

88 Acres: sustainable, allergen-friendly food from a women-led business

Reflecting its commitment to investing in women-led social enterprises and in sustainable, healthful, and whole food companies, RSF is supporting 88 Acres by purchasing $1.5 million of a $2.5 million revolving line of credit from Walden Savings Bank. The funding will fuel 88 Acres through a period of exceptional growth, helping it deliver on a contract to provide nut-free, vegan, and health-conscious snack bars to Delta Airlines. The company expects to double in size in 2024.

Motivated by her now-husband’s surprise allergic reaction on their fourth date, founder Nicole Ledoux built her company to supply allergen-friendly foods while fostering a more inclusive and empowered community. Rather than take the more typical route of using a contract manufacturer, the maker of seed-based bars and butters partnered with a neighborhood economic development group and a local food startup accelerator to build a small-scale bakery in urban Boston, where it could control the production environment and provide neighborhood jobs.

Natural Investments: converting ownership to democratize decision-making

Facilitated in part by a $1 million loan from RSF, Natural Investments became one of the first 50 businesses in the U.S. to convert to perpetual purpose trust ownership—and the first wealth advisory firm to make this bold transition. The loan, officially closed Dec. 29, 2023, supports Natural Investments’ move to democratize its governance and reduce the power long held largely by white male partners.

In place of individual ownership, the new structure puts power in the hands of an adviser-elected Trust Stewardship Committee. Each Trust Steward serves a term and has an equal vote on strategic and financial decisions. The move provides an exit strategy for existing partners while passing power to a younger, more diverse generation of leaders—the first Trust Stewardship Committee is 43% women and 29% people of color.

All three loans are financed through RSF’s Social Investment Fund, which enables investors to directly support high-impact social enterprises while earning a financial return. See other borrowers supported by SIF investors here.

RSF Social Finance | https://rsfsocialfinance.org/

SolarBank Corporation (NASDAQ: SUUN) (CBOE CA: SUNN) (FSE: GY2) ("SolarBank" or the "Company") announces that it has partnered with TriMac Engineering of Sydney, Nova Scotia to develop a 10 MW DC community solar garden in the rural community of Enon, and three 7 MW DC projects in Sydney, Halifax and Annapolis, Nova Scotia respectively (the "Projects"). The Projects are being developed under a Community Solar Program that was announced by the Government of Nova Scotia on March 1, 2024 and are owned by AI Renewable Fund.

The highlights of the Community Solar Program are as follows:

There are many reasons why people can't install solar panels on their homes, including lack of roof space, too much shade, living in an apartment, condo or other shared housing arrangement, or cost. The Community Solar Program will make solar energy an option for people in these situations. New gardens under the Community Solar Program are expected to be up and running by spring 2026.

TriMac and SolarBank are currently planning to apply for Community Solar Program Contract from the province by July 2024. If approved, construction would be expected to commence in 2025.

SolarBank Corporation | www.solarbankcorp.com

Alternative Energies May 15, 2023

The United States is slow to anger, but relentlessly seeks victory once it enters a struggle, throwing all its resources into the conflict. “When we go to war, we should have a purpose that our people understand and support,” as former Secretary ....

Unleashing trillions of dollars for a resilient energy future is within our grasp — if we can successfully navigate investment risk and project uncertainties.

The money is there — so where are the projects?

A cleaner and more secure energy future will depend on tapping trillions of dollars of capital. The need to mobilize money and markets to enable the energy transition was one of the key findings of one of the largest studies ever conducted among the global energy sector C-suite. This will mean finding ways to reduce the barriers and uncertainties that prevent money from flowing into the projects and technologies that will transform the energy system. It will also mean fostering greater collaboration and alignment among key players in the energy space.

Interestingly, the study found that insufficient access to finance was not considered the primary cause of the current global energy crisis. In fact, capital was seen to be available — but not being unlocked. Why is that? The answer lies in the differing risk profiles of energy transition investments around the world. These risks manifest in multiple ways, including uncertainties relating to project planning, public education, stakeholder engagement, permitting, approvals, policy at national and local levels, funding and incentives, technology availability, and supply chains.

Interestingly, the study found that insufficient access to finance was not considered the primary cause of the current global energy crisis. In fact, capital was seen to be available — but not being unlocked. Why is that? The answer lies in the differing risk profiles of energy transition investments around the world. These risks manifest in multiple ways, including uncertainties relating to project planning, public education, stakeholder engagement, permitting, approvals, policy at national and local levels, funding and incentives, technology availability, and supply chains.

These risks need to be addressed to create more appealing investment opportunities for both public and private sector funders. This will require smart policy and regulatory frameworks that drive returns from long-term investment into energy infrastructure. It will also require investors to recognize that resilient energy infrastructure is more than an ESG play — it is a smart investment in the context of doing business in the 21st century.

Make de-risking investment profiles a number one priority

According to the study, 80 percent of respondents believe the lack of capital being deployed to accelerate the transition is the primary barrier to building the infrastructure required to improve energy security. At the same time, investors are looking for opportunities to invest in infrastructure that meets ESG and sustainability criteria. This suggests an imbalance between the supply and demand of capital for energy transition projects.

How can we close the gap?

One way is to link investors directly to energy companies. Not only would this enable true collaboration and non-traditional partnerships, but it would change the way project financing is conceived and structured — ultimately aiding in potentially satisfying the risk appetite of latent but hugely influential investors, such as pension funds. The current mismatch of investor appetite and investable projects reveals a need for improving risk profiles, as well as a mindset shift towards how we bring investment and developer stakeholders together for mutual benefit. The circular dilemma remains: one sector is looking for capital to undertake projects within their skill to deploy, while another sector wonders where the investable projects are.

This conflict is being played out around the world; promising project announcements are made, only to be followed by slow progress (or no action at all). This inertia results when risks are compounded and poorly understood. To encourage collaboration between project developers and investors with an ESG focus, more attractive investment opportunities can be created by pulling several levers: public and private investment strategies, green bonds and other sustainable finance instruments, and innovative financing models such as impact investing.

Expedite permitting to speed the adoption of new technologies

Another effective strategy to de-risk investment profiles is found in leveraging new technologies and approaches that reduce costs, increase efficiency, and enhance the reliability of energy supply. Research shows that 62 percent of respondents indicated a moderate or significant increase in investment in new and transitional technologies respectively, highlighting the growing interest in innovative solutions to drive the energy transition forward.

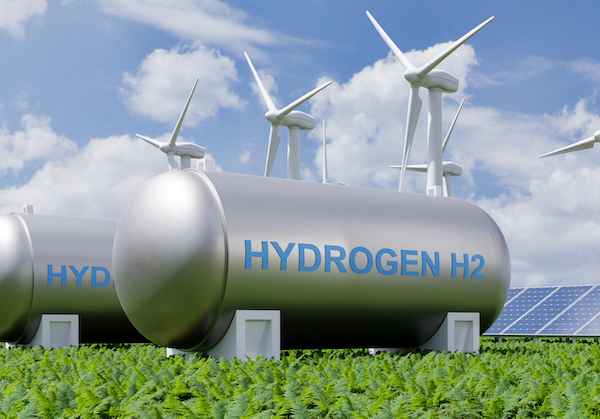

Hydrogen, carbon capture and storage, large-scale energy storage, and smart grids are some of the emerging technologies identified by survey respondents as having the greatest potential to transform the energy system and create new investment opportunities. However, these technologies face challenges such as long lag times between conception and implementation.

If the regulatory environment makes sense, then policy uncertainty is reduced, and the all-important permitting pathways are well understood and can be navigated. Currently, the lack of clear, timely, and fit-for-purpose permitting is a major roadblock to the energy transition. To truly unleash the potential of transitional technologies requires the acceleration of regulatory systems that better respond to the nuance and complexity of such technologies (rather than the current one-size-fits all approach). In addition, permitting processes must also be expedited to dramatically decrease the period between innovation, commercialization, and implementation. One of the key elements of faster permitting is effective consultation with stakeholders and engagement with communities where these projects will be housed for decades. This is a highly complex area that requires both technical and communication skills.

The power of collaboration, consistency, and systems thinking

The report also reveals the need for greater collaboration among companies in the energy space to build a more resilient system. The report shows that, in achieving net zero, there is a near-equal split between those increasing investment (47 percent of respondents), and those decreasing investment (39 percent of respondents). This illustrates the complexity and diversity of the system around the world. A more resilient system will require all its components – goals and actions – to be aligned towards a common outcome.

Another way to de-risk the energy transition is to establish consistent, transparent, and supportive policy frameworks that encourage investment and drive technological innovation. The energy transition depends on policy to guide its direction and speed by affecting how investors feel and how the markets behave. However, inconsistent or inadequate policy can also be a source of uncertainty and instability. For example, shifting political priorities, conflicting international standards, and the lack of market-based mechanisms can hinder the deployment of sustainable technologies, resulting in a reluctance to commit resources to long-term projects.

Variations in country-to-country deployment creates disparities in energy transition progress. For instance, the 2022 Inflation Reduction Act in the US has posed challenges for the rest of the world, by potentially channeling energy transition investment away from other markets and into the US. This highlights the need for a globally unified approach to energy policy that balances various national interests while addressing a global problem.

To facilitate the energy transition, it is imperative to establish stable, cohesive, and forward-looking policies that align with global goals and standards. By harmonizing international standards, and providing clear and consistent signals, governments and policymakers can generate investor confidence, helping to foster a robust energy ecosystem that propels the sector forward.

Furthermore, substantive and far-reaching discussions at international events like the United Nations Conference of the Parties (COP), are essential to facilitate this global alignment. These events provide an opportunity to de-risk the energy transition through consistent policy that enables countries to work together, ensuring that the global community can tackle the challenges and opportunities of the energy transition as a united front.

Keeping net-zero ambitions on track

Despite the challenges faced by the energy sector, the latest research reveals a key positive: 91 percent of energy leaders surveyed are working towards achieving net zero. This demonstrates a strong commitment to the transition and clear recognition of its importance. It also emphasizes the need to accelerate our efforts, streamline processes, and reduce barriers to realizing net-zero ambitions — and further underscores the need to de-risk energy transition investment by removing uncertainties.

The solution is collaborating and harmonizing our goals with the main players in the energy sector across the private and public sectors, while establishing consistent, transparent, and supportive policy frameworks that encourage investment and drive technological innovation.

These tasks, while daunting, are achievable. They require vision, leadership, and action from all stakeholders involved. By adopting a new mindset about how we participate in the energy system and what our obligations are, we can stimulate the rapid progress needed on the road to net zero.

Dr. Tej Gidda (Ph.D., M.Sc., BSc Eng) is an educator and engineer with over 20 years of experience in the energy and environmental fields. As GHD Global Leader – Future Energy, Tej is passionate about moving society along the path towards a future of secure, reliable, and affordable low-carbon energy. His focus is on helping public and private sector clients set and deliver on decarbonization goals in order to achieve long-lasting positive change for customers, communities, and the climate. Tej enjoys fostering the next generation of clean energy champions as an Adjunct Professor at the University of Waterloo Department of Civil and Environmental Engineering.

GHD | www.ghd.com

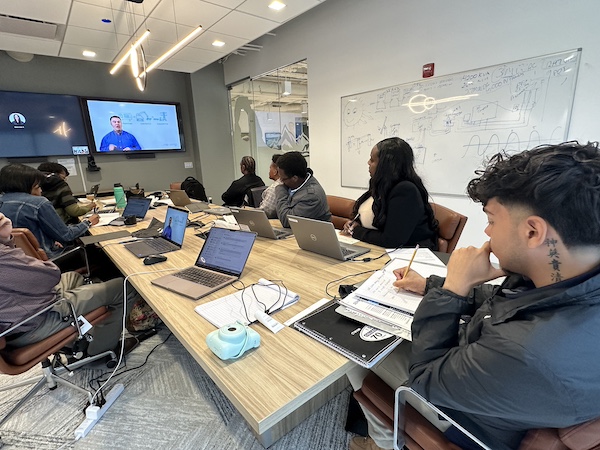

The Kincardine floating wind farm, located off the east coast of Scotland, was a landmark development: the first commercial-scale project of its kind in the UK sector. Therefore, it has been closely watched by the industry throughout its installation. With two of the turbines now having gone through heavy maintenance, it has also provided valuable lessons into the O&M processes of floating wind projects.

In late May, the second floating wind turbine from the five-turbine development arrived in the port of Massvlakte, Rotterdam, for maintenance. An Anchor Handling Tug Supply (AHTS)

vessel was used to deliver the KIN-02 turbine two weeks after a Platform Supply Vessel (PSV) and AHTS had worked to disconnect the turbine from the wind farm site. The towing vessel became the third vessel used in the operation.

This is not the first turbine disconnected from the site and towed for maintenance. In the summer of 2022, KIN-03 became the world’s first-ever floating wind turbine that required heavy maintenance (i.e. being disconnected and towed for repair). It was also towed from Scotland to Massvlakte.

Each of these operations has provided valuable lessons for the ever-watchful industry in how to navigate the complexities of heavy maintenance in floating wind as the market segment grows.

The heavy maintenance process

When one of Kincardine’s five floating 9.5 MW turbines (KIN-03) suffered a technical failure in May 2022, a major technical component needed to be replaced. The heavy maintenance strategy selected by the developer and the offshore contractors consisted in disconnecting and towing the turbine and its floater to Rotterdam for maintenance, followed by a return tow and re-connection. All of the infrastructure, such as crane and tower access, remained at the quay following the construction phase. (Note, the following analysis only covers KIN-03, as details of the second turbine operation are not yet available).

Comparing the net vessel days for both the maintenance and the installation campaigns at this project highlights how using a dedicated marine spread can positively impact operations.

For this first-ever operation, a total of 17.2 net vessel days were required during turbine reconnection—only a slight increase on the 14.6 net vessel days that were required for the first hook-up operation performed during the initial installation in 2021. However, it exceeds the average of eight net vessel days during installation. The marine spread used in the heavy maintenance operation differed from that used during installation. Due to this, it did not benefit from the learning curve and experience gained throughout the initial installation, which ultimately led to the lower average vessel days.

The array cable re-connection operation encountered a similar effect. The process was performed by one AHTS that spent 10 net vessel days on the operation. This compares to the installation campaign, where the array cable second-end pull-in lasted a maximum of 23.7 hours using a cable layer.

Overall, the turbine shutdown duration can be broken up as 14 days at the quay for maintenance, 52 days from turbine disconnection to turbine reconnection, and 94 days from disconnection to the end of post-reconnection activities.

What developers should keep in mind for heavy maintenance operations

This analysis has uncovered two main lessons developers should consider when planning a floating wind project: the need to identify an appropriate O&M port, and to guarantee that a secure fleet is available.

Floating wind O&M operations require a port with both sufficient room and a deep-water quay. The port must also be equipped with a heavy crane with sufficient tip height to accommodate large floaters and reach turbine elevation. Distance to the wind farm should also be taken into account, as shorter distances will reduce towing time and, therefore, minimize transit and non-productive turbine time.

During the heavy maintenance period for KIN-03 and KIN-02, the selected quay (which had also been utilized in the initial installation phase of the wind farm project), was already busy as a marshalling area for other North Sea projects. This complicated the schedule significantly, as the availability of the quay and its facilities had to be navigated alongside these other projects. This highlights the importance of abundant quay availability both for installation (long-term planning) and maintenance that may be needed on short notice.

At the time of the first turbine’s maintenance program (June 2022), the North Sea AHTS market was in an exceptional situation: the largest bollard pull AHTS units contracted at over $200,000 a day, the highest rate in over a decade.

During this time, the spot market was close to selling out due to medium-term commitments, alongside the demand for high bollard pull vessels for the installation phase at a Norwegian floating wind farm project. The Norwegian project required the use of four AHTS above a 200t bollard pull. With spot rates ranging from $63,000 to $210,000 for the vessels contracted for Kincardine’s maintenance, the total cost of the marine spread used in the first repair campaign was more than $4 million.

Developers should therefore consider the need to structure maintenance contracts with AHTS companies, either through frame agreements or long-term charters, to decrease their exposure to spot market day rates as the market tightens in the future.

While these lessons are relevant for floating wind developers now, new players are looking towards alternative heavy O&M maintenance options for the future. Two crane concepts are especially relevant in this instance. The first method is for a crane to be included in the turbine nacelle to be able to directly lift the component which requires repair from the floater, as is currently seen on onshore turbines. This method is already employed in onshore turbines and could be applicable for offshore. The second method is self-elevating cranes with several such solutions already in development.

The heavy maintenance operations conducted on floating turbines at the Kincardine wind farm have provided invaluable insights for industry players, especially developers. The complex process of disconnecting and towing turbines for repairs highlights the need for meticulous planning and exploration of alternative maintenance strategies, some of which are already in the pipeline. As the industry evolves, careful consideration of ports, and securing fleet contracts, will be crucial in driving efficient and cost-effective O&M practices for the floating wind market.

Sarah McLean is Market Research Analyst at Spinergie, a maritime technology company specializing in emission, vessel performance, and operation optimization.

Spinergie | www.spinergie.com

According to the Energy Information Administration (EIA), developers plan to add 54.5 gigawatts (GW) of new utility-scale electric generating capacity to the U.S. power grid in 2023. More than half of this capacity will be solar. Wind power and battery storage are expected to account for roughly 11 percent and 17 percent, respectively.

A large percentage of new installations are being developed in areas that are prone to extreme weather events and natural disasters (e.g., Texas and California), including high wind, tornadoes, hail, flooding, earthquakes, wildfires, etc. With the frequency and severity of many of these events increasing, project developers, asset owners, and tax equity partners are under growing pressure to better understand and mitigate risk.

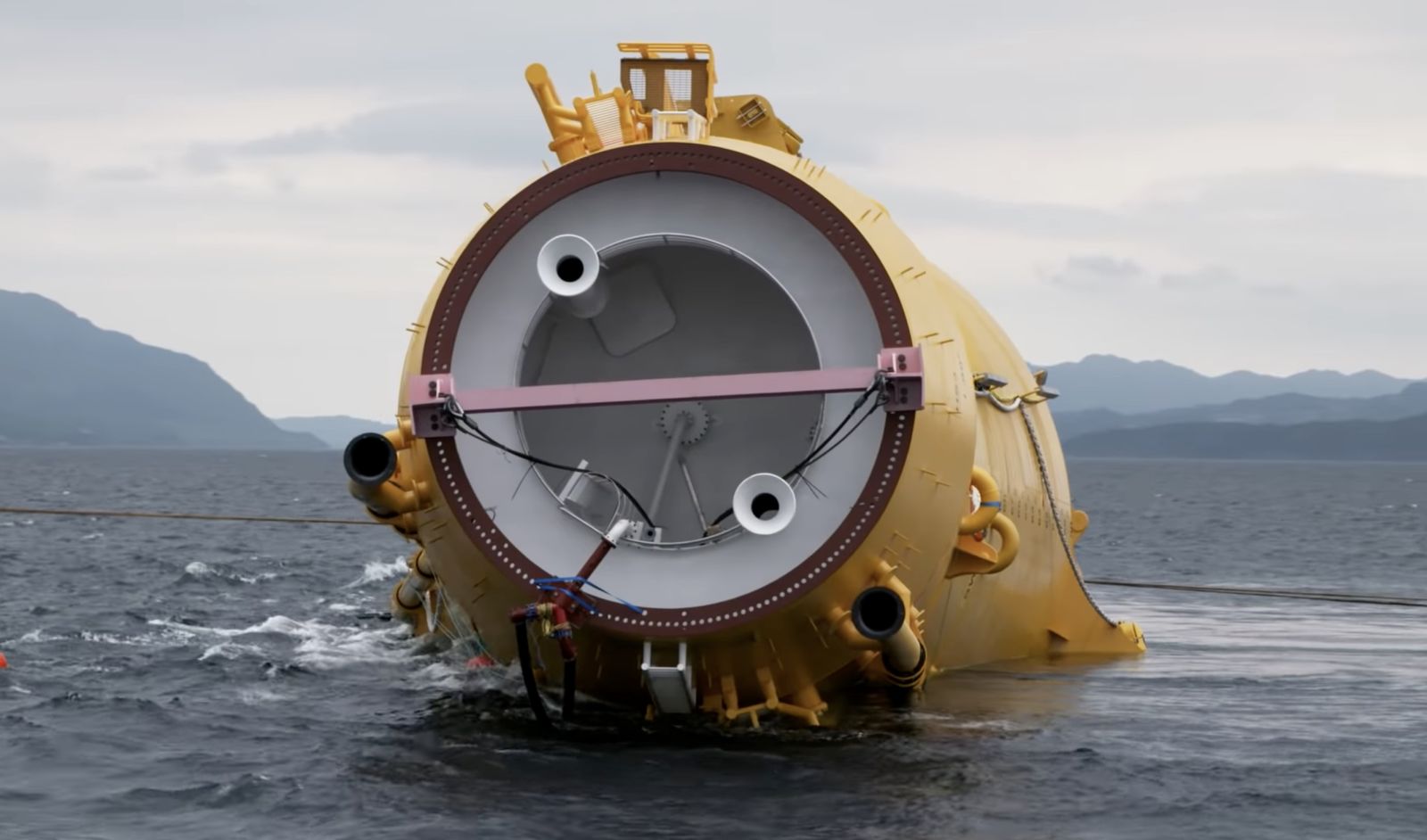

Figure 1. The history of billion-dollar disasters in the United States each year from 1980 to 2022 (source: NOAA)

In terms of loss prevention, a Catastrophe (CAT) Modeling Study is the first step to understanding the exposure and potential financial loss from natural hazards or extreme weather events. CAT studies form the foundation for wider risk management strategies, and have significant implications for insurance costs and coverage.

Despite their importance, developers often view these studies as little more than a formality required for project financing. As a result, they are often conducted late in the development cycle, typically after a site has been selected. However, a strong case can be made for engaging early with an independent third party to perform a more rigorous site-specific technical assessment. Doing so can provide several advantages over traditional assessments conducted by insurance brokerage affiliates, who may not possess the specialty expertise or technical understanding needed to properly apply models or interpret the results they generate. One notable advantage of early-stage catastrophe studies is to help ensure that the range of insurance costs, which can vary from year to year with market forces, are adequately incorporated into the project financial projections.

The evolving threat of natural disasters

Over the past decade, the financial impact of natural hazard events globally has been almost three trillion dollars. In the U.S. alone, the 10-year average annual cost of natural disaster events exceeding $1 billion increased more than fourfold between the 1980s ($18.4 billion) and the 2010s ($84.5 billion).

Investors, insurers, and financiers of renewable projects have taken notice of this trend, and are subsequently adapting their behavior and standards accordingly. In the solar market, for example, insurance premiums increased roughly four-fold from 2019 to 2021. The impetus for this increase can largely be traced back to a severe storm in Texas in 2019, which resulted in an $80 million loss on 13,000 solar panels that were damaged by hail.

The event awakened the industry to the hazards severe storms present, particularly when it comes to large-scale solar arrays. Since then, the impact of convective weather on existing and planned installations has been more thoroughly evaluated during the underwriting process. However, far less attention has been given to the potential for other natural disasters; events like floods and earthquakes have not yet resulted in large losses and/or claims on renewable projects (including wind farms). The extraordinary and widespread effect of the recent Canadian wildfires may alter this behavior moving forward.

A thorough assessment, starting with a CAT study, is key to quantifying the probability of their occurrence — and estimating potential losses — so that appropriate measures can be taken to mitigate risk.

All models are not created equal

Industrywide, certain misconceptions persist around the use of CAT models to estimate losses from an extreme weather event or natural disaster.

Often, the perception is that risk assessors only need a handful of model inputs to arrive at an accurate figure, with the geographic location being the most important variable. While it’s true that many practitioners running models will pre-specify certain project characteristics regardless of the asset’s design (for example, the use of steel moment frames without trackers for all solar arrays in a given region or state), failure to account for even minor details can lead to loss estimates that are off by multiple orders of magnitude.

The evaluation process has recently become even more complex with the addition of battery energy storage. Relative to standalone solar and wind farms, very little real-world experience and data on the impact of extreme weather events has been accrued on these large-scale storage installations. Such projects require an even greater level of granularity to help ensure that all risks are identified and addressed.

Even when the most advanced modeling software tools are used (which allow for thousands of lines of inputs), there is still a great deal that is subject to interpretation. If the practitioner does not possess the expertise or technical ability needed to understand the model, the margin for error can increase substantially. Ultimately, this can lead to overpaying for insurance. Worse, you may end up with a policy with insufficient coverage. In both cases, the profitability of the asset is impacted.

Supplementing CAT studies

In certain instances, it may be necessary to supplement CAT models with an even more detailed analysis of the individual property, equipment, policies, and procedures. In this way, an unbundled risk assessment can be developed that is tailored to the project. Supplemental information (site-specific wind speed studies and hydrological studies, structural assessment, flood maps, etc.) can be considered to adjust vulnerability models.

This provides an added layer of assurance that goes beyond the pre-defined asset descriptions in the software used by traditional studies or assessments. By leveraging expert elicitations, onsite investigations, and rigorous engineering-based methods, it is possible to discretely evaluate asset-specific components as part of the typical financial loss estimate study: this includes Normal Expected Loss (NEL), also known as Scenario Expected Loss (SEL); Probable Maximum Loss (PML), also known as Scenario Upper Loss (SUL); and Probabilistic Loss (PL).

Understanding the specific vulnerabilities and consequences can afford project stakeholders unique insights into quantifying and prioritizing risks, as well as identifying proper mitigation recommendations.

Every project is unique

The increasing frequency and severity of natural disasters and extreme weather events globally is placing an added burden on the renewable industry, especially when it comes to project risk assessment and mitigation. Insurers have signaled that insurance may no longer be the main basis for transferring risk; traditional risk management, as well as site and technology selection, must be considered by developers, purchasers, and financiers.

As one of the first steps in understanding exposure and the potential capital loss from a given event, CAT studies are becoming an increasingly important piece of the risk management puzzle. Developers should treat them as such by engaging early in the project lifecycle with an independent third-party practitioner with the specialty knowledge, tools, and expertise to properly interpret models and quantify risk.

Hazards and potential losses can vary significantly depending on the project design and the specific location. Every asset should be evaluated rigorously and thoroughly to minimize the margin for error, and maximize profitability over its life.

Chris LeBoeuf is Global Head of the Extreme Loads and Structural Risk division of ABS Group, based in San Antonio, Texas. He leads a team of more than 60 engineers and scientists in the US, UK, and Singapore, specializing in management of risks to structures and equipment related to extreme loading events, including wind, flood, seismic and blast. Chris has more than 20 years of professional experience as an engineering consultant, and is a recognized expert in the study of blast effects and blast analysis, as well as design of buildings. He holds a Bachelor of Science in Civil Engineering from The University of Texas at San Antonio, and is a registered Professional Engineer in 12 states.

Chris LeBoeuf is Global Head of the Extreme Loads and Structural Risk division of ABS Group, based in San Antonio, Texas. He leads a team of more than 60 engineers and scientists in the US, UK, and Singapore, specializing in management of risks to structures and equipment related to extreme loading events, including wind, flood, seismic and blast. Chris has more than 20 years of professional experience as an engineering consultant, and is a recognized expert in the study of blast effects and blast analysis, as well as design of buildings. He holds a Bachelor of Science in Civil Engineering from The University of Texas at San Antonio, and is a registered Professional Engineer in 12 states.

ABS Group | www.abs-group.com

Throughout my life and career as a real estate developer in New York City, I’ve had many successes. In what is clearly one of my most unusual development projects in a long career filled with them, I initiated the building of a solar farm to help t....

I’m just going to say it, BIPV is dumb. Hear me out…. Solar is the most affordable form of energy that has ever existed on the planet, but only because the industry has been working towards it for the past 15 years. Governments,....

Heat waves encircled much of the earth last year, pushing temperatures to their highest in recorded history. The water around Florida was “hot-tub hot” — topping 101° and bleaching and killing coral in waters around the peninsula. Phoenix had ....

Wind turbines play a pivotal role in the global transition to sustainable energy sources. However, the harsh environmental conditions in which wind turbines operate, such as extreme temperatures, high humidity, and exposure to various contaminants, p....

Wind energy remains the leading non-hydro renewable technology, and one of the fastest-growing of all power generation technologies. The key to making wind even more competitive is maximizing energy production and efficiently maintaining the assets. ....

The allure of wind turbines is undeniable. For those fortunate enough to visit these engineering marvels, it’s an experience filled with awe and learning. However, the magnificence of these structures comes with inherent risks, making safety an abs....

Battery energy storage is a critical technology to reducing our dependence on fossil fuels and build a low carbon future. Renewable energy generation is fundamentally different from traditional fossil fuel energy generation in that energy cannot be p....

Not enough people know that hydrogen fuel cells are a zero-emission energy technology. Even fewer know water vapor's outsized role in electrochemical processes and reactions. Producing electricity through a clean electrochemical process with water....

In the ever-evolving landscape of sustainable transportation, a ground-breaking shift is here: 2024 ushers in a revolutionary change in Electric Vehicle (EV) tax credits in the United States. Under the Inflation Reduction Act (IRA), a transforma....

Now more than ever, it would be difficult to overstate the importance of the renewable energy industry. Indeed, it seems that few other industries depend as heavily on constant and rapid innovation. This industry, however, is somewhat unique in its e....

University of Toronto’s latest student residence welcomes the future of living with spaces that are warmed by laptops and shower water. In September 2023, one of North America’s largest residential passive homes, Harmony Commons, located....

For decades, demand response (DR) has proven a tried-and-true conservation tactic to mitigate energy usage during peak demand hours. Historically, those peak demand hours were relatively predictable, with increases in demand paralleling commuter and ....